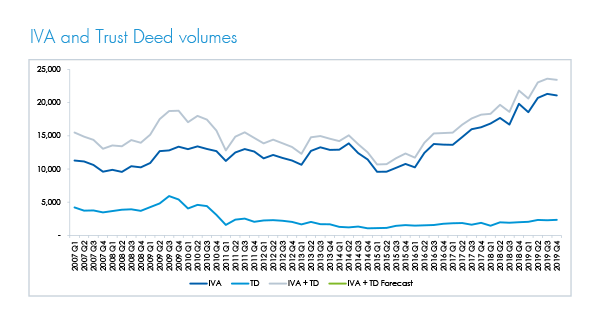

IVAs and Trust Deeds set new records again in 2019

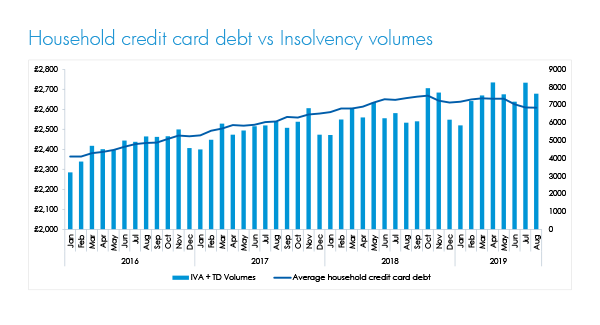

Just as 2018 was a record year for IVA and trust deed volumes, 2019 saw new volumes of IVAs and trust deeds increase further, reaching new record levels.

There are a number of potentially contributing factors:

- Outstanding consumer credit lending in the UK now stands at over £225 billion*, which is likely to lead to increased consumer demand for debt solutions.

- Almost five million Britons headed into 2020 with more than £10,000 of debt, some owing as much as £100,000**.

- A further nine million people owe between £2,000 and £10,000, according to Money.co.uk***. The figures also suggest that almost two-thirds of the UK’s adults (63%), head into 2020 in some form of debt.

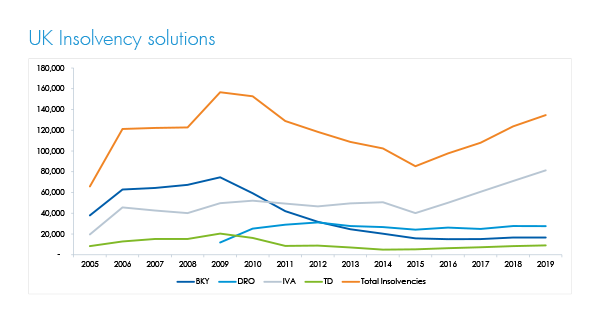

Debt Relief Orders and bankruptcies continued at subdued levels, largely unchanged for the last four years. Commercial debt firms continue to apply their focus on debt management plans, IVAs, and Trust Deeds, whereas the more charitable organisations continue to offer debt relief orders and bankruptcies.

The IVA market

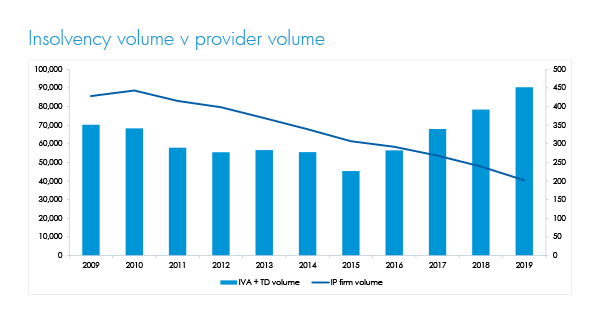

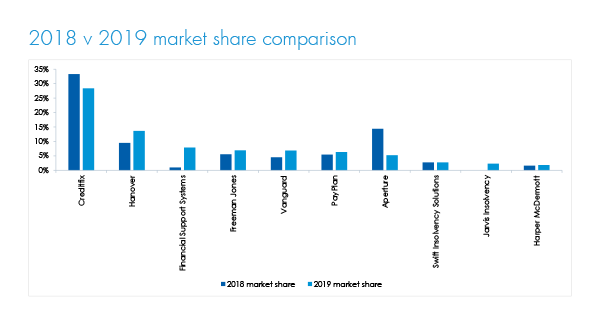

Market consolidation continues to be a factor, with Creditfix acquiring two new books in 2019; Pinnacle and Pareto. PayPlan also acquired a small practice (Shawcross Williams) from administration.

Aperture (the UK’s second largest IVA provider) ceased writing new IVAs in 2019, with the book now being supervised to an orderly closure over the next 5-6 years.

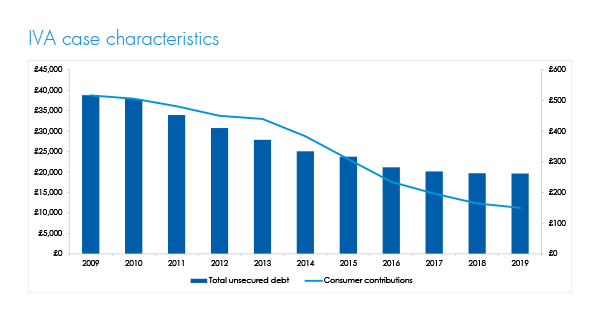

Although average income has increased over the past three years, average expenditure has matched the growth. Consumer monthly payments into an IVA have more than halved in the past five years and the average total unsecured debt level has dropped to the lowest ever level in 2019.**

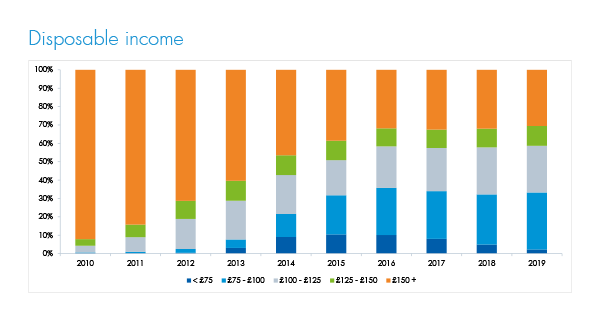

Consumer disposable income has stayed fairly static over the past four years but in 2019, for the first time, there has been more cases with a disposable income between £75 - £100 than over £150. The volume of consumers receiving the majority of their income from benefits has continued to decrease.

Consumers’ disposable income has seen a substantial change from 2010 where 92% of consumers were offering over £150 a month to their IVA, compared to just 31% in 2019.

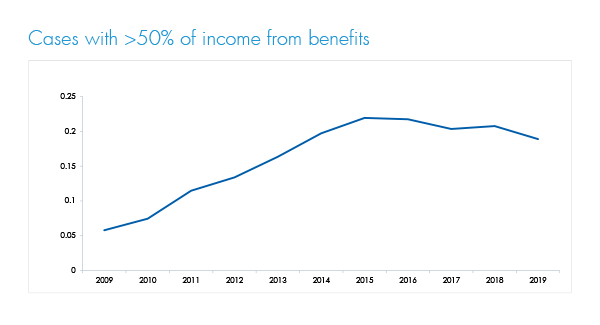

IVA consumers’ reliance on benefits has been decreasing since 2015 but still remains far higher than 10 years ago. 19% of consumers in 2019 received over 50% of their income through benefits.

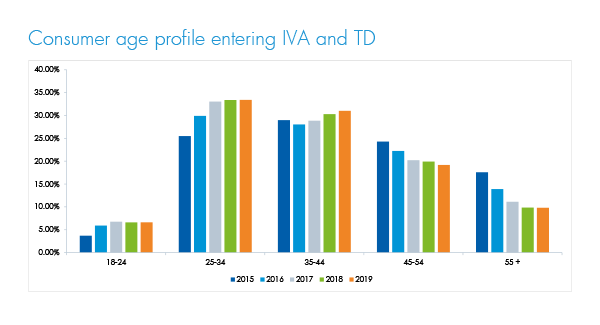

Consumers entering IVAs and Trust Deeds have become younger. Over 40% of new cases in 2019 were for consumers under 35, compared to just 30% five years ago.

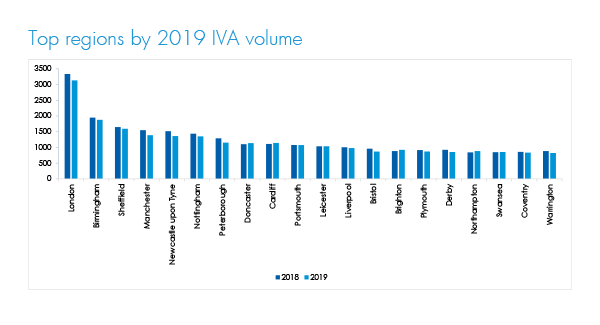

London and the next top five biggest cities (by IVA volume) saw a decrease in IVA volumes in 2019 as the smaller regions saw an increase. Leeds is the biggest city not in the top 20 regions for IVA volume.

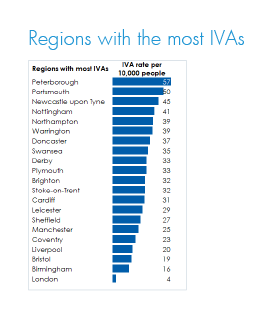

Peterborough tops the list of cities with the most IVAs per 10,000. In contrast to IVA volume data, when placed in order of cities with the most IVAs per 10,000 people, London comes in 21st place.

The UK’s credit card debt increased in 2019 alongside insolvency volumes.

The future

Breathing Space and the Statutory Debt Management Plan are still being finalised, though the implementation dates have fallen back, the latest estimates being the end of 2020 and 2021 respectively.

Read more on proposals

In July 2019, the Insolvency Service launched a consultation entitled “regulation of insolvency practitioners’ review of current regulatory landscape”. It ran until October with feedback currently being collated and analysed. The general points for consideration were:

- Understanding whether the regulatory objectives were working and having their intended effect.

- Do these objectives encourage a competitive profession with reasonable costs?

- Promoting the maximisation of returns to creditors.

- Protecting and promoting the public interest and having confidence in the regime.

- Should there be a single regulator and what would that look like?

The output is expected this year and could potentially lead to significant changes within the regulation of Insolvencies.

Read more on the consultation

Whilst the overall view of outstanding consumer credit continues to increase, there are potentially some factors that may lessen the impact on the debt industry.

UK consumers made net repayments on their credit cards for the first time in almost seven years. Households across the country reined in their spending.

The Bank of England reported the first monthly fall in credit card debts since July 2013 after borrowers repaid around £100 million in November 2019 to reflect fading demand for consumer credit.

The annual growth rate in unsecured consumer lending dropped to 5.7% from 6.1% in October, as households limited their spending on credit cards.

In conclusion

- Outstanding consumer credit lending in the UK now stands at over £225 billion as around five million Britons head into 2020 with more than £10,000 of debt.

- IVA volumes have continued to grow significantly in the last four years to record numbers in 2019.

- Breathing Space and the Statutory Debt Management Plan implementation dates have been delayed and estimated now to be the end of 2020 and 2021 respectively.

- Consumers entering IVAs and Trust Deeds have become younger.

- IVA consumers’ reliance on benefits has decreased for four years in a row.

- Peterborough is the region with the most IVAs per 10,000 people whilst London tops the total number of IVAs per city.

Sources:

* https://www.money.co.uk/press/more-than-half-of-uk-adults-will-head-into-the-2020-saddled-with-a-personal-debt-of-up-to-100000.htm

** https://themoneycharity.org.uk/money-statistics/

*** The Insolvency Exchange, TDX Group

Download