If you are unable to see the video, please click on the link here

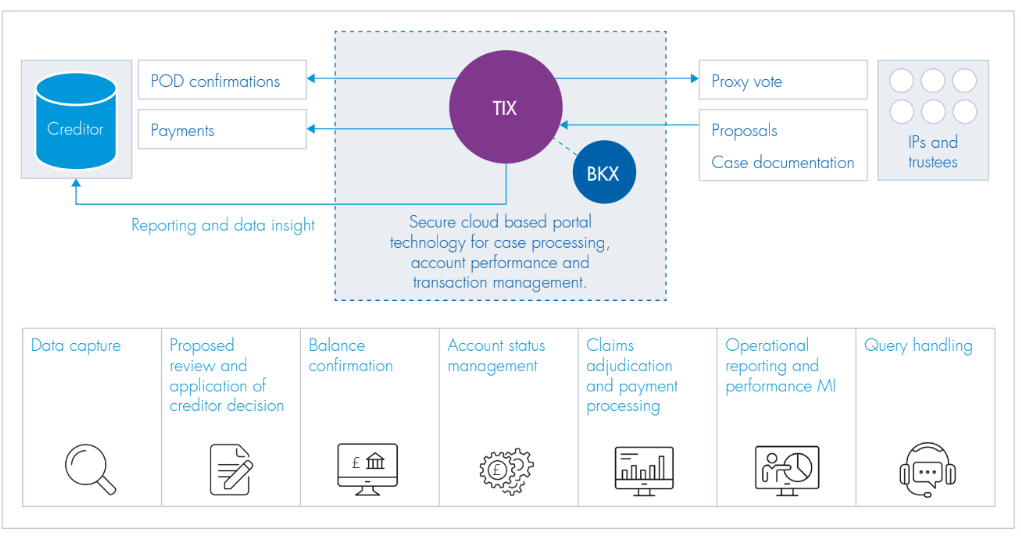

The Insolvency Exchange (TIX) encompasses all aspects of managing personal insolvencies, including trust deeds and IVAs.

Bankruptcies and sequestrians can be managed as an additional capability to the core TIX service through an additional capability, Bankruptcy Exchange (BKX).

We manage 1.4m accounts

We offer scalability, insight and expertise, operating across multiple sectors and managing 1,400,000 IVA accounts.

How TIX works

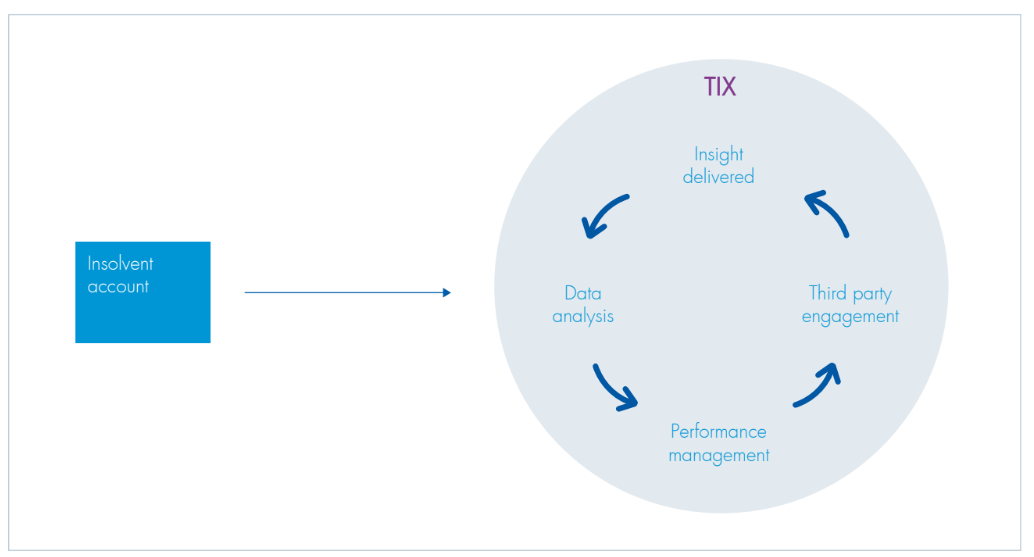

When an insolvent account is placed into TIX it becomes part of a continuous optimisation cycle. We’ve highlighted the key points below but for more in depth information on each stage download our TIX brochure.

Data analysis and insight delivered

Our in-house analytics team creates management information that’s delivered back to creditors and can enable a better understanding of their portfolio.

Performance management

TIX monitors account repayment performance and can help improve liquidation performance.

Third party engagement

TIX has a dedicated IP and trustee relationship team (extending to regulatory bodies) that ensure creditors are appropriately represented in committees and are kept up-to-date on industry changes.

Benefits of using TIX to manage personal insolvencies

Reduce operational overheads

|

Improve visibility of cases

|

Improve liquidation and value

|

Improve sustainability and fair treatment

|

Download the brochure